Historically Challenging Year

The first three quarters of 2022 have been difficult to navigate. Stocks and bonds have both experienced broadly negative returns. Even within the respective markets, almost all allocations have struggled year-to-date. The only standout allocations that have been able to notch positive returns are energy and commodities, and since mid-year, commodities have given back some of their gains.

Equity Revaluation

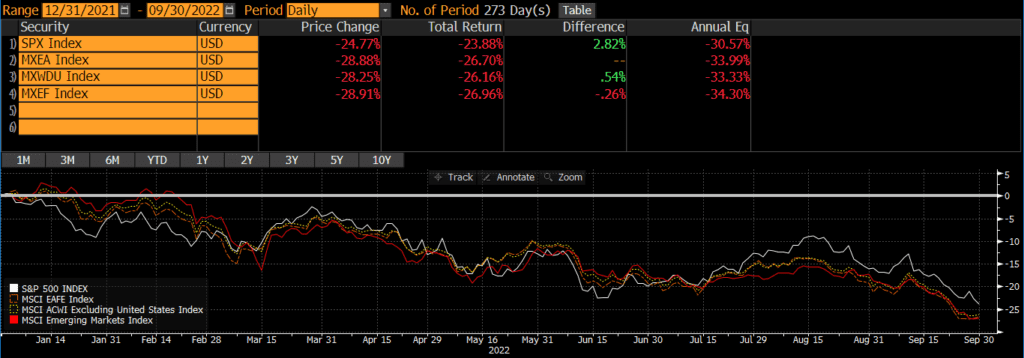

The equity indices below show the trend through the first three quarters. Globally, stocks have moved lower each quarter, ending September down roughly 25%. We have experienced significant rallies along the way, but each has failed as the move again turned lower.

The general reset in equity markets does point to better opportunities ahead. Current P/E ratios have begun to look reasonably attractive. We have seen this revaluation in U.S., Developed International, and Emerging Markets.

Regions/Styles: Current NTM P/E vs. 10-Year High, Low, Average

To our eye, given the tenuous geopolitical backdrop and its implications, domestic equities have an advantage over their peers in parts of the world facing greater uncertainty around security, energy, and growth.

Geopolitical Stress in the System

The uncertainty, exacerbated by the pandemic and certain countries responses to it, have fueled a deglobalization movement. While securing supply chains was perhaps the initial driver of the movement, the impetus has broadened. The U.S. government has begun to encourage re-shoring or friend-shoring, bringing supply chains back to the U.S., or at a minimum, to countries that are allies of the U.S. This push is likely to benefit companies whose earnings are domestically focused, providing a tailwind for small-cap U.S. companies.

There is also a growing national security concern. We can no longer blindly depend on suppliers based within countries that seek to undermine the U.S. and its allies, to deliver the inputs that are necessary for essential infrastructure and existential defense. This can be seen in President Biden’s technological decoupling push in the export controls recently placed on semiconductor technology, attempting to limit China’s access to the most advanced chips. Use of force to reunite Taiwan and subjugate its people would likely drive a broader break between democratic nations and the Chinese Communist Party (CCP).

Timothy Calkins, CFA

Co-Chief Investment Officer

Timothy serves as a member of the Nottingham Investment Policy Committee. He brings over 22 years of investment experience to the team. Timothy is responsible for corporate and municipal credit research & trading, as well as contributing to our economic outlook and interest rate expectations. He also leads our alternative investment research and custom allocations, with a focus on private credit and liquid alternatives. Timothy’s membership and active participation with the Buffalo Angels group keep him connected to the local start-up community.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadv.flywheelstaging.com or call 716-633-3800.

Nottingham Advisors, LLC (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.