Worst Start to a Half in Over 50 Years

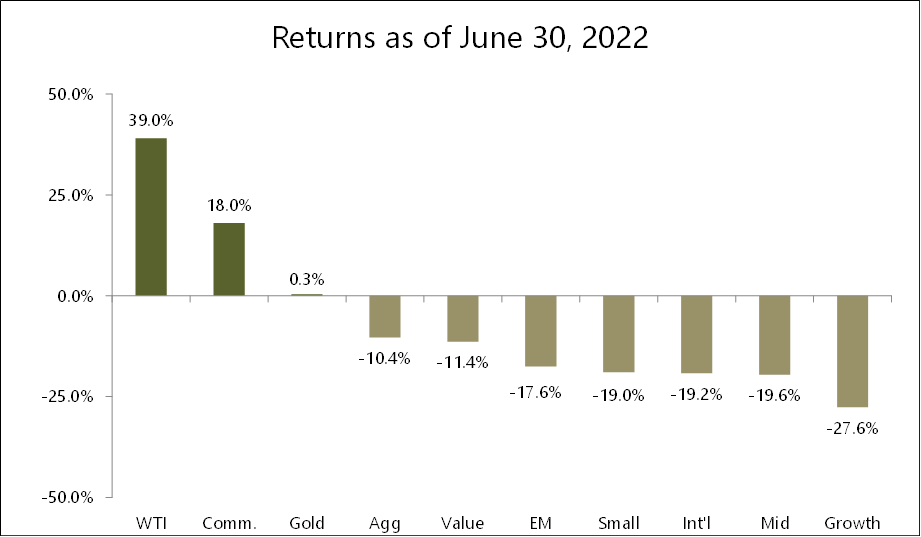

With the first six months of the year in the books, U.S. equities capped their worst first half of a year since 1970. U.S equities ended the month of June on a low note, bringing to an end a volatile first half of the year that saw the benchmark S&P 500 fall -20.0% to close at 3,785. US Mid- and Small-Caps performed roughly in line with Large-Caps, down -19.6% and -19.0%, respectively. From an international standpoint, both Developed Markets (DM) and Emerging Markets (EM) equities posted similar declines, down -19.2% and -17.6%, respectively. Global equity markets have largely been indiscriminant in their selling, with US Large-, Mid-, and Small-Caps all performing roughly in line with DM and EM benchmarks. Bonds provided minimal hedge value, with the Bloomberg Aggregate shedding -10.4% as the Federal Reserve raised interest rates to combat inflation. Commodities finished the first half of the year in positive territory, with the Bloomberg Commodities Index gaining +18.0%. Within the index, Gold remained largely flat, up a scant +0.3%, while West Texas Intermediate (WTI) crude oil was the standout up +39.0%.

From a style perspective, Growth stocks, as measured by the S&P 500 Growth Index, closed out a difficult first half of the year with a -27.6% drop. On the other hand, Value stocks, as measured by the S&P 500 Value Index, lost -11.41% year to date, a more than 16 percentage point outperformance compared to Growth.

At the regional level, the Eurozone, as measured by the MSCI EMU Index, is down -18.11%, despite the geopolitical headwinds facing the bloc. Additional new headwinds likely remain, including French President Macron losing a majority of parliament, a hawkish European Central Bank (ECB) contending with rising bond yields in Italy, and the unforeseeable consequences of both Sweden and Finland joining NATO. With inflation accelerating and energy prices surging, the Eurozone’s headwinds are perhaps a bit different than those in the U.S. due to the lack of available tools to combat them. As we go to press, the Euro has fallen to parity with the Dollar for the first time in over 20 years, which is welcome news to US vacationers, but a new headache for Eurozone countries trying to fight inflation as a weaker currency adds fuel to the fire.

Within EM, China was a notable standout, falling only -10.61% on the year. Last month’s performance helped tremendously, with the MSCI China Index gaining +6.66%. June marked the end of Shanghai’s two-month lockdown, relaxed travelling restrictions, the re-opening of Shanghai Disney, and a visit from President Xi to Hong Kong. While anecdotal, all point to a relaxing of COVID-19 restrictions, even though not an outright end to “Zero Covid” policy. While not without their own unique risks, Chinese equities are becoming more attractive on a relative basis as additional stimulus measures are embraced, whereas most of the rest of the world is tightening monetary conditions.

Matthew Krajna, CFA

Co-Chief Investment Officer

Matthew joined Nottingham in 2012 and is a member of the Investment Policy Committee. He brings over 13 years of investment experience to the team. Matthew is responsible for conducting investment research, due diligence, and contributing to Nottingham Advisors overall investment strategy. Additionally, He is responsible for establishing the firm’s strategic and tactical asset allocations. Matthew works with investment advisors and both individual clients & institutions to help build customized investment solutions to fit their needs.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadv.flywheelstaging.com or call 716-633-3800.

Nottingham Advisors, LLC (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.